Dalam pembelajaran mengenai MA ini, Anda hanya akan membahas dua jenis MA yang terkenal saja, yaitu:

1.Simple Moving Average (SMA)

2.Exponential Moving Average ( EMA)

Anda akan mempelajari dasar-dasarnya dulu, gres nanti Anda akan pelajari strateginya. Oke, ini dia….

1.Simple Moving Average (SMA)

Simple Moving Average (SMA) ini merupakan MA yang paling sederhana. Ya, sesuai dengan namanya: simple. Tapi jangan remehkan kemampuan si Sekolah Menengan Atas yang sederhana ini, sebab dengan penggunaan yang sempurna ia pun bisa menuntun Anda untuk mengenali pergerakan harga. Jika Anda memakai Sekolah Menengan Atas 50 di grafik 1 jam-an, maka Sekolah Menengan Atas 50 yang Anda lihat yakni hasil dari penjumlahan 50 harga penutupan terakhir, kemudian hasil penjumlahan itu dibagi lagi dengan 50. Dari perhitungan itulah Anda bisa memperoleh nilai rata-rata dari harga penutupan dalam 50 jam terakhir. Sudah sanggup gambarannya kan? Oke, kita lanjutkan.

Seperti yang pernah disampaikan, pada prakteknya Anda tidak perlu susah-susah lagi menghitung Sekolah Menengan Atas ini, platform trading yang Anda gunakan sudah menyediakan alatnya. Lho, kemudian mengapa repot-repot mempelajari perhitungannya? Tujuannya hanya supaya Anda mempunyai gambaan mengenai apa sesungguhnya Sekolah Menengan Atas ini. Juga supaya Anda mempunyai dasar kalau nanti Anda ingin memodifikasi Sekolah Menengan Atas ini sesuai dengan taktik Anda nantinya.

Seperti yang telah disampaikan di awal tadi: MA “memperhalus” pergerakan harga. Semakin besar periode yang dipakai maka semakin “halus” pula MA yang dihasilkan. Semakin halus MA yang dihasilkan maka akan semakin lambat ia bereaksi terhadap pergerakan harga.

2.Exponential Moving Average (EMA)

Perhitungan EMA tidaklah sesederhana SMA. EMA menawarkan bobot yang lebih dalam perhitungan harga rata-rata dalam rentang waktu tertentu. Efeknya yakni EMA cenderung lebih sensitif terhadap pergerakan harga , sehingga EMA bergerak sedikit lebih bergairah daripada SMA. EMA & Sekolah Menengan Atas Sample Gambar di atas menunjukkan Sekolah Menengan Atas dan EMA yang diplot pada grafik yang sama. Periode yang dipakai juga sama-sama 50 namun metode perhitungannya berbeda.

MA yang berwarna biru yakni EMA, sedangkan MA yang berwarna merah yakni SMA. Anda bisa melihat bahwa EMA 50 selalu lebih bersahabat kepada Sekolah Menengan Atas 50. Ini artinya EMA lebih merepresentasikan pergerakan harga (price action) daripada SMA. Dengan kata lain, EMA lebih menggambarkan apa yang terjadi di pasar dikala ini.

Strategi ini dinamakan The 3 Musketeer sebab memakai 3 indikator Moving Average. Masing-masing indikator mempunyai kiprah penting dalam algoritma sanksi harga.

Cara Kerja:

1.Pertama Pasang 3 unit EMA (Exponential Moving Average) dengan parameter sebagai berikut:

- EMA 1; Period 8, Method Exponential, Apply to Close, Warna Merah

- EMA 1; Period 8, Method Exponential, Apply to Close, Warna Merah

|

| Exponential Moving Average Period 8 |

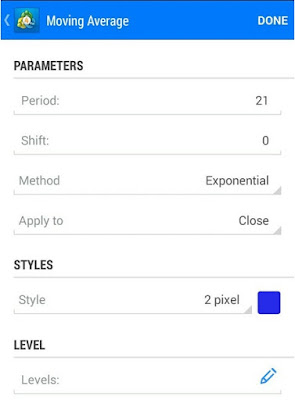

- EMA 2; Period 21, Method Exponential, Apply to Close, Warna Biru

|

| Exponential Moving Average Period 21 |

- EMA 3; Period 125, Method Exponential, Apply to Close, Warna Hitam

|

| Setting Exponential Moving Average Period 125 |

Timeframe

Rekomendasi Terbaik: D1 (Daily)

Opsional: H4 (4 Jam)

Penjelasan

EMA 1 dan 2 berfungsi sebagai trigger / alarm untuk pengambilan poisi. EMA 3 berfungsi sebagai penentu Trend.

Aturan Entry (eksekusi order)

#Buy:

- Tentukan demam isu dengan EMA 3. Jika gugusan candle berada diatas garis EMA 3, maka selanjutnya tunggu sinyal Buy.

- Eksekusi Buy ketika 2 garis EMA 1 dan EMA 2 berpotongan mengarah keatas. Biasanya garis EMA1 memotong EMA 2.

#Sell:

- Tentukan demam isu dengan EMA 3. Jika gugusan candle berada dibawah garis EMA 3, maka selanjutnya tunggu sinyal Sell.

- Eksekusi Sell ketika 2 garis EMA 1 dan EMA 2 berpotongan mengarah bawah. Biasanya garis EMA1 memotong EMA 2.

Algoritma Exit (Take Profit & Stop Loss)

- Take Profit: sekitar 50 - 300 poin. Bisa diadaptasi dengan Resisten terdekat.

- Stop Loss: sekitar 50 - 100 poin. Bisa diadaptasi dengan Support terdekat.

Strategi ini dibentuk khusus untuk timeframe D1 atau H4. Kami tidak menganjurkan penggunaan di timeframe lebih kecil dari itu.

Apakah taktik ini bisa dijadikan EA? Bisa saja. Tapi performanya tidak akan sebaik kita menjalankannya secara manual. EA tidak bisa membaca informasi dan sentimen sebaik manusia.

Jika ada pertanyaan bisa eksklusif melalui kolom komentar di bawah.

Salam Profit!

Penjelasan

EMA 1 dan 2 berfungsi sebagai trigger / alarm untuk pengambilan poisi. EMA 3 berfungsi sebagai penentu Trend.

Aturan Entry (eksekusi order)

#Buy:

|

| Aturan Entry Buy |

- Tentukan demam isu dengan EMA 3. Jika gugusan candle berada diatas garis EMA 3, maka selanjutnya tunggu sinyal Buy.

- Eksekusi Buy ketika 2 garis EMA 1 dan EMA 2 berpotongan mengarah keatas. Biasanya garis EMA1 memotong EMA 2.

#Sell:

|

| Aturan Entry Sell |

- Tentukan demam isu dengan EMA 3. Jika gugusan candle berada dibawah garis EMA 3, maka selanjutnya tunggu sinyal Sell.

- Eksekusi Sell ketika 2 garis EMA 1 dan EMA 2 berpotongan mengarah bawah. Biasanya garis EMA1 memotong EMA 2.

Algoritma Exit (Take Profit & Stop Loss)

- Take Profit: sekitar 50 - 300 poin. Bisa diadaptasi dengan Resisten terdekat.

- Stop Loss: sekitar 50 - 100 poin. Bisa diadaptasi dengan Support terdekat.

SARAN PENGGUNAAN

Strategi trading ini bekerja mengikuti trend. Ketiga Moving Average mempunyai kiprah masing-masing sebagai Trend Detector dan Sinyal. Untuk akurasi sebaiknya dicoba sendiri memakai akun demo.Strategi ini dibentuk khusus untuk timeframe D1 atau H4. Kami tidak menganjurkan penggunaan di timeframe lebih kecil dari itu.

Apakah taktik ini bisa dijadikan EA? Bisa saja. Tapi performanya tidak akan sebaik kita menjalankannya secara manual. EA tidak bisa membaca informasi dan sentimen sebaik manusia.

Jika ada pertanyaan bisa eksklusif melalui kolom komentar di bawah.

Salam Profit!